The global apparel and textile market includes fiber and yarn companies, textile manufacturers, apparel manufacturers and retailers.

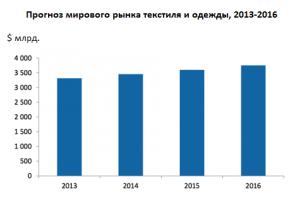

According to Marketline, the global textiles, apparel and luxury goods market was valued at approximately $3 trillion. in 2011, with a compound annual growth rate (CAGR) of 4% during the period 2009-2013.

Industry Key Markets

The US textile industry generated about $57 billion in revenue in 2013, up 5% from 2012, according to the Congressional Research Service. The US textile industry invested $19 billion in new plants and equipment between 2001 and 2012, according to the US Census Bureau.

Since then, manufacturers including Gildan Activewear, Parkdale Mills, Zagis USA and Keer have announced plans to increase domestic production of yarns, nonwovens and technical fabrics by opening new textile plants or expanding existing facilities, Textile World reports.

In the European Union (EU), in 2013, according to EURATEX, textile industry revenues amounted to $104 million. The total turnover of the clothing market in the EU was $94 billion in 2013, which is 3% less than in 2012. Women's clothing remained the largest sector.

China continues to lead the world in clothing and textile exports. According to the World Trade Organization (WTO), China's exports were valued at $284 billion in 2013 and accounted for 37% of global clothing and textile exports that year. China emerged as the largest supplier of both textiles and clothing to EU countries in 2013, followed by Turkey and Bangladesh.

Key players in the clothing and textile market

The global apparel and textile market is fragmented and diverse, ranging from fabrics to ready-made garments from world-renowned suppliers and includes all types of retailers even home textile stores. The main clothing manufacturers in the world are Christian Dior, Nike and Inditex.

Christian Dior is a French luxury goods company with revenues of $39 billion in 2013. The company's products are ready-made clothing. The brand is widely known for its offerings for women. According to the company, it distributes its products through both stores and online sales.

Nike is an American company that designs, develops, manufactures and markets footwear, apparel, equipment, accessories and services. Its 2014 revenues were $28 billion. It sells products under brands such as Nike Golf, Nike Pro, Nike+, Air Jordan, Air Force 1, Nike Dunk, Foamposite, Nike Skateboarding, and through subsidiaries including Converse. According to the company, Nike uses a combination of retail stores and e-commerce platforms to sell its products.

Inditex is a Spanish clothing manufacturer with revenues of $17 billion in 2014. The company has more than 6,460 stores in 88 countries. It owns well-known high-end brands such as Zara, Pull & Bear, Massimo Dutti, Bershka, Stradivarius, Oysho and Uterque. The company began online sales in 2007 and plans to expand e-commerce. Inditex currently has an online presence in 25 markets, according to the company.

Market forecast by sales

The global textiles, apparel and luxury goods market will grow at a CAGR of 4% between 2011 and 2016, reaching $3.7 trillion. in 2016, Marketline predicts.

Treaties aimed at economic development and increasing trade signed between countries are factors that will stimulate the market for the global textile and apparel industry.

Key trends and growth strategies in the textile and apparel industry

Currently, there are four main trends in the textile and clothing market.

Consumers demand new products

Customers are increasingly demanding that high street stores offer new looks and fashion across all clothing categories: women's clothing, men's clothing and even lingerie and children's clothing. With new trends constantly evolving in fashion shows, this trend poses a significant challenge for clothing manufacturers.

Apparel companies must take advantage of improved computer-aided design and 3D printing technology to produce faster and more accurate prototypes. To reduce lead times, manufacturers should also strengthen and expand their supplier base and engage in collaborative sourcing plans. This will reduce supply variance and promote reliable and timely sourcing.

Functional fabrics are important in sportswear

The high-tech or performance clothing market is one of the fastest growing sectors of the apparel industry. It includes clothing that offers extra performance for a specific function, such as sports or work. Examples include antimicrobial fibers and fabrics for sporting goods, flame retardant or high tenacity fibers and fabrics, moisture wicking fabrics, UV protective fibers and fabrics, and waterproof breathable fabrics. The use of smart digital technologies in clothing and accessories, for example to measure body functions, is also increasing.

Apparel manufacturers must invest in functional fabric technologies as this market offers higher margins than traditional clothing.

Changes in textile industry criticized

The textile and apparel industry faces significant criticism over its environmental and ethical practices. Excessive use of water resources, chemicals and heavy labor give the industry a bad reputation.

To counter criticism, manufacturers must be more responsible. They must monitor working conditions in factories, quality, and pay attention to protection against counterfeiting and waste recycling. Players should also come up with new initiatives in the industry to reduce pollution. For example, The Voluntary Inter-industry Commerce Solutions (VICS) advocates for thinner, recyclable hangers that use 30% less plastic than the original VICS standards.

Governments encourage producers of natural textiles

Governments are encouraging the development of domestically grown natural fiber production to reduce dependence on polyester materials and imports. For example, the Indonesian government promotes the use of locally grown agricultural commodities such as silk and cotton.

Textile manufacturers should take advantage of government incentives to produce high quality fabrics at reasonable prices.

The Diesel company, founded by the Italian Renzo Rosso in 1978, strives to meet all these trends and requirements imposed by the world market on manufacturers. Jackets, sweaters, shoes, as well as stylish men's jeans Diesel meet international quality standards, are widely known and popular in many countries around the world.

Russia has a raw material base for the light and textile industries, but it consists mainly of natural ingredients - wool, leather, fur, flax. Russian manufacturers are still highly dependent on imported raw materials, especially synthetic and chemical components, and market participants see this as both a pressing problem and potential for industry development.

Imported vs local raw materials

According to reviews from representatives of almost all segments of the light and textile industry, one of the most pressing issues for the industry today is the development of the raw material base. Russian manufacturers use imported and domestic raw materials approximately 50/50, and this creates certain difficulties in all areas of business.

One of the most pressing issues for the industry today is the development of the raw material base.For example, according to Alexander Kruglik, president of OJSC Roslegprom, the textile industry mainly works on imported cotton, and it is possible to compete only through the production of new types of fabrics and their high-quality finishing. “This is the merit of entrepreneurs (the industry is private), and enterprise teams, and the Ministry of Industry and Trade, which has truly become the headquarters of the industry,” says Alexander Kruglik. At the same time, we need to work on expanding local sources of raw materials.

“I would like to improve the linen sub-industry. Linen was fashionable, it was produced here, and the fabric was sold for export. Now the fashion has passed - production has decreased, flax crops have decreased. The same problems with wool. We need wool with fine fiber, and so far we produce little of it. Leather workers do not have enough raw materials. Factories are operating at only 60-70% capacity. And leather is a competitive product, 30% of which is now sold to France, Germany, and Spain. That is, we have potential for growth.”

Alexander Kruglik President of OJSC Roslegprom

Imported raw materials include synthetic shoe materials for the uppers and linings of shoes and clothing, insole materials, threads, accessories, protective elements, reflective materials, and chemical raw materials for the production of soles. These materials are not produced in Russia, and many of the specific materials simply cannot be replaced with something else.

According to industry players, the local raw material base needs to be developed and improved. Since Russia is traditionally strong in natural raw materials (leather, fur, wool), we are more likely talking about the production of modern synthetic materials with various functional properties, chemical components, textile materials and insulation materials, materials and components with specialized protective properties (antistatic, fire resistance, durability to aggressive mechanical influences - cuts, punctures, chemicals, etc.). This will also have a positive impact on the growth of production in Russia, reduce dependence on currency exchange rate fluctuations on the market, optimize production costs and, as a result, have a positive impact on prices for Russian products for the end consumer.

There are also prospects for the growth of agricultural raw materials for light industry, including in connection with import substitution. Recently, a joint meeting of representatives of the Ministry of Agriculture, the Ministry of Industry and Trade, leading research institutes, industry unions and a number of leading manufacturers was held, at which Evgeniy Akhpashev, director of the department of food and processing industry of the Ministry of Agriculture, shared data on the growing demand for linen product line in many segments of the light and textile industry. industry. According to him, today the industrial cultivation of flax is carried out in more than 20 regions of Russia, and the total sown “flax area” is approximately 50 thousand hectares. True, so far the quality of flax fiber leaves much to be desired compared to imported analogues. The introduction of new technologies, modern equipment, and the creation of new modern production facilities and laboratories is required. However, if this issue is resolved and taking into account the growing demand, the linen sector has good potential for dynamic development.

Viscose - current situation

The production of viscose raw materials in the world increases by 8% every year. The largest producer is still China (about 60%). The greatest potential for growth in viscose fiber consumption over the next 10 years is in the technical and medical textiles segments, including personal hygiene items, with growth of about 6% annually. In the traditional segments of clothing and home textiles, the consumption of viscose and the displacement of cotton will also continue to increase, but the forecast growth rates are slightly lower (3-4%).

Reference:

65% of the volume of viscose fibers is produced by integrated companies, the technological chain of which includes the production of dissolving pulp and fibers/threads. These are the largest companies such as Lenzing, Austria (21% of the market - includes the production stages of dissolving cellulose and viscose fibers and threads), Aditya Birla, India (18% of the market - includes the stages of production of dissolving cellulose, viscose fibers, fabrics and clothing), Sateri , China (8% of the market - includes the stages of production of dissolving pulp and viscose fibers and threads) and Fulida, China (6% of the market - includes stages of production of dissolving cellulose, viscose fibers, fabrics).

In Russia in 2016, the volume of consumption of chemical and artificial fibers and threads by Russian light industry enterprises amounted to 372 thousand tons, while viscose fibers and threads accounted for only 3.6% - 13.5 thousand tons.

A modern plant for the production of viscose fibers pays for itself with a minimum production volume of 100-150 thousand tons per year. According to Ksenia Sosnina, General Director of the Ilim Group, there is potential for growth in domestic demand for viscose fiber and threads of the order of 20-25 thousand tons. Increasing the localization of finished product production from 20% to 40% will increase domestic demand by another 70-80 thousand tons. However, despite this, domestic demand in the medium term will not be able to ensure the workload of the new enterprise without the development of exports.

Thus, it is economically feasible to create Russian production facilities with a focus on export supplies while simultaneously stimulating the development of textile production and creating “pull” demand and gradually increasing fiber production volumes.

It is economically feasible to create a Russian production of viscose fibers with a focus on export supplies.Coniferous and viscose cellulose - problems and prospects

The volume of cellulose production in Russia is about 8 million tons, our country is in 8th place in the world in terms of this indicator. At the same time, cellulose production has great export potential. About 2.2 million tons are already exported, mainly to China, and this country cooperation can be developed.

“The production of dissolving cellulose has high export potential. We are quite capable of occupying the markets of many countries around the world. It is planned to implement a project for the construction of two plants for the production of dissolving cellulose with a capacity of 250-300 thousand tons per year and, in a separate direction, to develop the production chain of viscose fiber for light industry.”

Viktor Evtukhov State Secretary, Deputy Head of the Ministry of Industry and Trade

Current issues for pulp producers include the lack of modern production capacity (base), underinvestment in the segment, as well as the fact that the industry is highly consolidated and divided between several large holdings, including those with foreign owners.

However, there are already positive results in addressing these issues, including those related to import substitution. For example, successes can be noted in the segment of sanitary and hygienic products. Over the past six years, the share of imported products has decreased from 53% to 8%, primarily due to the localization of production of international players (SCA, Hayat Kimya companies).

In addition, almost all large pulp and paper mills in the Irkutsk and Arkhangelsk regions (Ilim group), in the Komi Republic (Mondi SYLPK JSC) and Karelia (Segezha group) carried out large-scale reconstructions, which made it possible to update production and increase pulp production by 30%.

An important current task is the formation of large clusters based on existing sites, as well as the launch of new projects. It is planned to create a special tax regime for producers of softwood and hardwood pulp within the clusters, because, according to expert estimates, by 2030 a powerful increase in global demand for softwood pulp is predicted (from 27.4 million tons in 2015 to 35 million tons in 2030) , for hardwood pulp (from 7.2 million tons to 50 million tons).

An important task is the formation of large industrial clusters based on existing production facilities and the launch of new projects.Another interesting segment is the production of viscose pulp, the demand for which will double over the next 15 years (to 16 million tons). Factors influencing this segment are the substitution of cotton with viscose in the production of clothing, the substitution of petrochemical products in other segments. Viscose cellulose is not produced in Russia, and the expected demand for viscose cellulose in the country by 2030 will be about 130 thousand tons.

Prospects

Light industry is a strategic and innovative industry. And the country has all the resources to develop the industry. Petroleum and petrochemicals are the basis for synthetic chemical fibers and threads; forest is involved in the production of artificial fibers, such as viscose cellulose, which is in great demand in the world today.

Large-scale and capital-intensive projects to create new production capacities will be implemented on the basis of so-called investment and technology partnerships. The implementation tool will be special investment contracts. At the same time, negotiations are already underway on concluding such contracts with representatives of the forestry business.

An example is the project for the construction of a pulp mill in the Khabarovsk Territory by the RFP Group together with Vnesheconombank and the Chinese company China Chentong Holdings Group. The volume of investment in the project could reach up to $1.5 billion. Its implementation will make it possible to produce about 500 thousand tons of bleached softwood kraft pulp and dissolving pulp per year.

Or another example - a plant is being built in the Trans-Baikal Territory to produce 400 thousand tons of unbleached cellulose. This project is being implemented with the participation of Chinese partners (the Sinban company) with a declared investment of 30 billion rubles. There is potential for the development of such production in the Krasnoyarsk and Khabarovsk territories, the Vologda and Irkutsk regions, as well as in the Far Eastern region in connection with the development of cooperation with China and other Asian countries. It is China, South Korea and Japan that account for the lion's share of exports. And today, the Chinese companies Chentong and CAMCE are already planning to participate in projects for the construction of pulp production in Russia.

Light industry unites many industries and sub-sectors, the main ones being textile, clothing and footwear. These industries are currently developing especially rapidly in newly industrialized countries and other developing countries, which is largely due to their high supply of raw materials and cheap labor. Industrialized countries, having lost their positions in a number of traditional mass, technically uncomplicated industries (cheap types of fabrics, shoes, clothing and other types of consumer products), retain a leading role in the manufacture of especially fashionable, high-quality, expensive products oriented towards high technology and labor qualifications, a limited circle of consumers (production of carpets, furs, jewelry, standards of shoes, clothing, fabrics from expensive raw materials, etc.).

The textile industry in the era of scientific and technological revolution significantly changed its structure. For a long period of time, the main branch of the world's textile industry remained cotton, followed by wool, linen and processing of man-made fibers. Currently, the share of chemical fibers in global fabric production has increased significantly, while the share of cotton, wool and especially flax has decreased. The creation of mixed fabrics from natural and chemical fibers and knitwear (knitted fabric) was of great importance. The share of chemical fibers in the textile industry of developed countries has especially increased. In the economies of developing countries, the main types of textile raw materials remain cotton, wool, and natural silk, although the share of products made from chemical fibers has recently increased significantly.

Textile industry In general, it is developing at a faster pace in the group of developing countries. Asia has become the main region of the textile industry in the world, providing today about 70% of the total amount of fabrics, more than half of the production of cotton and woolen fabrics.

The main producers of cotton fabrics are China (30% of world production), India (10%), USA, Japan, Taiwan, Indonesia, Pakistan, Italy, Egypt,

Among the leading producers of woolen fabrics are also a significant part of Asian countries. The world's largest manufacturer of these fabrics is China (15%), followed by Italy (14%), Japan, USA, India, Turkey, Republic of Korea, Germany, Great Britain, Spain.

And in the production of the most expensive silk fabrics, with the absolute leadership of the USA (over 50%), the share of Asian countries is also very large, especially India, China and Japan (more than 40%).

The production of linen fabrics decreased significantly. They are produced in large quantities only in Russia and Western European countries (France, Belgium, the Netherlands, Great Britain).

Developed countries of the world (especially the USA, Italy, Japan, Germany, France), while their share in the production of cotton and woolen fabrics is decreasing, remain the largest producers of knitwear and fabrics made from chemical fibers (synthetic and blended). Although in these types of textile industries their role is steadily declining due to the organization of production in developing countries (India, China, the Republic of Korea, Taiwan, etc.).

In Russia, which was one of the largest manufacturers of all types of natural fabrics in the world, their production is experiencing a severe decline.

The importance of developing countries in production is also great clothing industry(linen, outerwear, etc.). Many of them, and above all China, India, South Korea, Taiwan, and Colombia, have become the largest producers and exporters of ready-made clothing. Developed countries (especially the USA, France, Italy, etc.) are increasingly specializing in the production of fashionable, elite, individual products,

Shoe industry Among the light industry sectors, the largest movement has moved from developed countries to countries with cheap labor - developing countries. The leaders in the production of footwear have become the People's Republic of China (which has overtaken the former leaders Italy and the USA in its production and produces more than 40% of footwear in the world) and other Asian countries - the Republic of Korea, Taiwan, Japan, Indonesia, Vietnam, Thailand. In developed countries (Italy, USA, Austria, Germany stand out), the production of leather shoes from expensive raw materials, with high labor intensity of production, has been preserved mainly. The developing countries of Asia specialize more in sports and indoor shoes. The largest manufacturer and exporter of such shoes is Italy. In Russia, shoe production has decreased several times in recent years, and the country has transformed from the world's largest shoe producer (in 1990, second only to China) into a significant importer.

Light industry in the world plays a significant role in the modern economy. It provides the population with household and industrial goods and consumer goods. Light industry closely interacts with agriculture and other areas.

Main characteristics

Light industry is understood as a set of industries that produce items from various raw materials for the population. Conventionally divided into two groups:

- The first is that it contains cheap mass products. Characterized by low-labor production and the presence of low-skilled labor.

- The second one produces expensive goods and is characterized by qualified workers and high-tech equipment.

In furniture production, Italy accounts for 8% (of the world total), the USA - 15%, and China about 25%.

Features of light industry include:

- tight connection to the territory and consumer;

- dependence on the economic level of the population;

- changes in fashion and preferences;

- periodic changes in requirements for production technologies and raw materials;

- quick change of assortment.

Light industry sectors have their own structure and include the following industries:

- raw materials – leather processing, production of flax, cotton, etc.;

- semi-products – dyeing, textile;

- finished goods – haberdashery, shoes, clothing.

The global light industry includes the main industries - textile (in first place), footwear and clothing. Feature: they are unevenly represented in the world economy.

Industries are developing successfully mainly in developing countries. This is explained by the presence of cheap labor and raw materials, and simple production. In developed countries, expensive products are often produced using skilled labor and high technology.

Textile industry

It occupies a leading position in the world's light industry. Worker employment and production volumes are leading among all others. Manufactured by:

- synthetic and natural fabrics;

- nonwoven materials;

- ropes;

- yarn;

- carpet products.

The textile industry is the oldest, it includes the production of cotton (first place), wool, silk, and chemical fibers.

Mixed fabrics are becoming the most popular; they contain about 50% cotton and 50% synthetic fibers. In global production, the share of synthetic fibers has increased significantly, while natural fibers have decreased.

Over the past 20 years, textile manufacturing has been moving towards countries in the Asian region. Main leaders:

- China;

- Taiwan;

- South Korea;

- India, Türkiye.

The share of developed countries in the industry has decreased significantly; they manage to maintain their position by producing more expensive textiles. Many developed countries have transferred part of their industry to developing regions. The production of nonwoven materials used for technical purposes is increasing. The majority of this sector belongs to China and EU countries (25%).

Light industry sectors

Garment industry

It is considered more labor-intensive than textile. Characterized by great demand and variety of goods. Manufacturing has shifted from developed to developing countries.

The latter occupy the largest part in the industry segment - about 80% of clothing exports. The leaders are China, Asia and Latin America. Developed countries specialize mainly in sewing expensive or exclusive products.

The clothing industry also includes the production (sewing) of toys. Production is developed in almost every region. The most significant suppliers are China, Japan and the USA.

There is an increase in investment flows for industry development in the Baltic countries. This is explained by the proximity of the Western market, low wages with sufficient qualifications of employees.

Leather and footwear industry

The footwear industry is evenly concentrated in both developing and developed regions. It is distinguished by a wide assortment, it is not inferior to the clothing industry, and a variety of raw materials. Natural (leather, nubuck, suede), synthetic (leatherette), and textile materials are used.

In developed countries, higher quality products are made from expensive raw materials. The undisputed leader is the large manufacturer Italy; back in the 50s, it was famous for its shoes. Countries such as the Czech Republic, Spain, Portugal, and Great Britain are not inferior to their positions. Expensive shoes take up a third of all shoe production.

The segment is no less saturated with cheap shoes made of textiles and leatherette. The leading position rightfully belongs to China - it covers 40% of total production, with Korea, Brazil, and Thailand in the middle of the ranking. Russia has significantly reduced volumes, gradually moving from producer to importer.

The production of fur products belongs to China, the USA, and Russia. Greece occupies a special place in this segment, where fur trimmings are processed.

China is a leader in the light industry; today the country continues to develop and conquer new markets.

Forecasts for industries

Key sectors of light industry focused on mass consumption (cheap shoes, clothing) are concentrated in developing regions. Developed countries are reserved for the production of high-quality products for a limited circle of consumers (high-tech products made from expensive raw materials).

The importance of light industry has a social orientation in the world economy. It provides the population with necessary consumer and household items, creates the comfort and well-being of citizens, and plays a significant role in the country’s economy.

Consumption rates vary, but the average is gradually increasing; buyers often return to the strategy of accumulating basic household items, which increases demand for the product.

Marketers assure that regulations for fulfilling the volume of the consumer basket exist at every enterprise, and it is not difficult to supply the population with the required number of units. The interest of buyers is studied, the indicators are verified by social surveys, the trend of fashion designers is also taken into account.

Video: Russian light industry

The structure of the industry is quite complex. It includes raw materials production (production of cotton from raw cotton, processing of animal skins), intermediate production (spinning, textile, dyeing, leather, fur), final production (sewing, knitting, carpet, haberdashery, shoe, etc.).

In the USA, the production of most mass, usually cheap, light industrial goods for 1950-2000. decreased several times. Therefore, the share of North America in the world has decreased: for footwear - from 48 to 10%, for cotton fabrics - from 30 to 6%, for woolen fabrics - from 26 to 6%. In Russia, as a result of the reforms of the 90s. light industry was destroyed. Modern Russia has not even entered the top ten producers of woolen fabrics and shoes, and has sharply reduced the production of linen and cotton fabrics.

Light industry includes about 30 large industries. Geographical problems in the development of light industry are associated with some of its features. Firstly, its products directly affect people's living standards. Secondly, it is a labor-intensive industry that predominantly employs women. Thirdly, the size of enterprises is usually small.

Light industry is characterized by less pronounced territorial specialization compared to other industries, since almost every region has one or another of its enterprises.

The factors for locating light industry enterprises are varied, but the main ones can be identified:

- raw materials, which primarily influences the location of enterprises for the primary processing of raw materials: for example, flax processing factories are located in flax production areas, wool washing enterprises - in sheep breeding areas, enterprises for the primary processing of leather - near large meat processing plants;

- consumer;

- labor resources, providing for their significant quantity and qualifications, since all branches of light industry use predominantly female labor.

Light industry in the capitalist world can be divided into two categories. The first is mass products for wide consumption, relatively cheap in cost, requiring medium and low-skilled labor. However, these industries are characterized by rapid turnover of assortments, sometimes even with changes in technology, since their products belong to the category of fashion goods that are frequently replaced.

Under these conditions, complete mechanization and gains due to the scale of production are impossible, since goods of even the same name are produced in small batches, differing from each other in individual parts. “Non-standard” is the main slogan of this production due to the special nature of consumer demand, which requires a variety of colors and models even of the same product.

Therefore, the cheapness of labor begins to play a decisive role, and not the level of technology. It is this circumstance that explains the increasing concentration of first category industries in the NIS countries and other developing countries. The share of developing countries (including NIS countries) in the production of cotton fabrics has increased from 20 to 40%. During the same time, their share in footwear production increased from 10 to 45%. Nowadays, almost half (by value) of the products of the mass light industries of the capitalist world is concentrated in developing countries and NIS countries.

The second group of industries, represented by expensive goods that require high qualifications in their production, as well as fairly high technology, still remains mainly a “monopoly” of developed countries. Although here too there is a tendency to shift production to developing countries, especially in the production of cheaper goods, the jewelry industry, the fur, carpet and even porcelain industries. Nevertheless, in such industries as furniture, over 80% of production is concentrated in developed countries, fur - 75%, jewelry - about 70% by value.

These three industries today account for about a third of global light industry production by value. But today, geographical shifts in light industry are most clearly manifested in its leading industry - the textile industry. Despite the fact that it belongs to typical old industries, in the era of scientific and technological revolution, the world production of textile fibers shows a constant growth trend. But at the same time, dramatic changes are occurring in the structure of fiber production, expressed in a decrease in the share of natural fiber and an increase in the share of chemical fiber.

There are five main regions in the global textile industry. East Asia, South Asia, CIS, foreign Europe and the USA. In each of them, the production of cotton fabrics and fabrics from chemical fibers predominates, while the remaining sub-sectors: wool, linen, silk are less important. But the ratio of these regions has changed over recent decades. Many old industrial areas that pioneered the Industrial Revolution have fallen into disrepair. In developing countries, on the contrary, there is a tendency towards accelerated growth of the textile industry, where it develops primarily due to the availability of cheap labor. Some countries already have a fairly well-established textile industry, here it is considered traditional: India, Pakistan, Bangladesh, Syria, Turkey, Brazil, Argentina, etc. In the NIS countries, on the contrary, it arose relatively recently, but on a modern basis.

Among the world leaders in the production of fabrics, the top five are China, India, Russia, the USA, and Japan. A significant portion of textiles, especially ready-made garments, from developing countries is exported to Western countries (see Appendix 24).

In the second half of the 20th century. Asia has become the leader of the world's light industry. China controls 25% of the market for sports and indoor footwear, a significant share of sales of cotton underwear, etc.

Western Europe refocused on modeling and designing new fashion products, providing a variety of production facilities with the most modern high-performance equipment, advertising the achievements of model houses, while maintaining the production of a few types of expensive garments, shoes, haberdashery, and various accessories.

In first place is the production of fabrics from chemical fibers, including the so-called mixed fabrics. In fact, this is the modern equivalent of the traditional silk and wool industry, since at present, fabrics made from chemical fibers are not only replacing, but also displacing traditional silk and wool fabrics. In addition, these fabrics compete with cotton and linen, especially “mixed fabrics”, where the raw materials also include natural fibers. An average of 32-35 billion m2 of such fabrics from chemical fiber are currently produced. The largest producers of such fabrics in the capitalist world are the USA, where the average annual production is about 10 billion m2, India - 3-4 billion m2, Japan - 3-4 billion m2, South Korea - 2-3 billion m2, Taiwan - 2-2.5 billion m 2, China, Germany. The remaining producers of the capitalist world produce less than 1 billion m 2.

At the same time, the main exporters of fabrics are South Korea, Taiwan, Japan, and such a large manufacturer as the USA exports less than 5% of its products, with South Korea's export quota of 75%.

Unlike the production of chemical fabrics, the production of cotton fabrics is increasingly becoming the province of developing countries. India currently occupies the first place among producers of cotton fabrics, China is close to it. The United States, which ranks third, already produces almost half as much cotton fabric as India. Average annual production in India fluctuates between 8-9.5 billion m2, in the USA - between 3.5-4 billion m2, Japan produced an average of 2 billion m2. Countries such as Italy, Germany, Taiwan, France, Egypt produced an average of 1 to 1.5 billion m2 of fabrics per year, and the once largest producer of cotton fabrics in the world - Great Britain - dropped to a level of 300 million m2 per year , inferior not only to South Korea, but even to Portugal.

The main exporters are developing countries such as Hong Kong, Pakistan, India, Egypt, Taiwan, which account for almost a third of the world's exports of cotton fabrics. Among developed countries, significant exporters are Germany, Japan, and Italy, supplying the highest quality types of fabrics. Total production reaches about 30 billion m2 per year, and exports - 7-8 billion m2 per year.

All other types of fabrics are produced in incomparably smaller quantities. Thus, the production of pure woolen fabrics amounts to 1.3-1.5 billion m2 per year, concentrating mainly in Western Europe, the USA, Japan and to a small extent in China and South Africa.

The production of linen fabrics is even smaller, concentrated primarily in France, as well as in Belgium, Holland and Great Britain. The production of natural silk, which at one time had almost disappeared, has begun to revive in the last 15 years, now concentrating in China, Japan and India, and to a very small extent in Italy and other Western European countries. In addition to factory fabrics, the world continues to produce handicraft fabrics on a significant scale, a certain part of which enters the world market in the form of artistic goods and is exported from developing countries to developed ones as luxury goods. The largest category of goods of this kind is “sari” fabric produced in India (according to various production estimates - 3-5 billion m2), part of which is exported. A significant part of the handicraft production of brocade, velvet and satin is exported. The largest exporters of these types of goods are India and China. The production of cashmere in India and Pakistan and the production of tiftik in Turkey also retain its export importance.

Carpet can be considered a special branch of the textile industry, which has developed extremely in the last quarter of a century. Nowadays, most of the factory-made carpets are so-called woven materials, and only a third are factory-made, traditionally knitted. The main materials are chemical fibers and only traditional knitted carpets are made from wool. The main manufacturer of carpets in the capitalist world (woven type) is the USA. In addition to them, Belgium and England are major exporters, exporting woven (knitted) carpets. The total production of factory-made carpets is approximately 5-7 billion m2 per year, while the production of handicraft carpets barely reaches 1 billion m2. India's largest manufacturer and exporter of handicraft carpets.

Knitting production currently plays a huge role, having become the main sub-industry of textile production in developed countries. In countries such as Germany, knitwear has long been on par with fabric production in terms of production costs, and in some years even surpasses them. However, in developed countries the production of expensive complex knitwear is now concentrated, and the production of cheap underwear is increasingly moving to developing countries, which have become the largest exporters of these products to the leading countries of the world. In terms of total production volume, the United States is in first place in the capitalist world, followed by Japan, Hong Kong, South Korea, and Germany.

The location of the textile industry is not the same for developed and developing countries. In developed countries, inherited from the past rural textile production, the proportion of textile areas with finely dispersed production is still large. These are, as a rule, small textile enterprises specialized in the production of complex types of textiles. Large factories tend to be concentrated in heavy industrial areas, where they make use of the available female labor force. There are almost no textile enterprises left in capital cities, and large specialized centers are generally rare.

On the contrary, developing countries are characterized by the concentration of the textile industry in large and important port cities. Because of this, textile centers in developing countries are often larger than in developed countries. Therefore, when naming the leading centers of the textile industry in the world, we will have to name Bombay in India, El Mahalla El Kubra in Egypt, Hong Kong and Sao Paulo in Brazil. At the same time, the largest areas of the textile industry in the world are the South Atlantic region in the USA, some points of which are not inferior in size to the above-mentioned cities.

The post-war period was a time of transformation of the clothing industry from custom semi-handicraft production, carried out mainly by home workers or in small workshops, into a powerful conveyor-type industry. At the same time, there is a shift in the clothing industry from developed to developing countries, covering a wide range of countries. Nowadays, countries such as Hong Kong or India are not inferior to leading capitalist countries not only in exports, but also in the overall capacity of the clothing industry. In terms of production value, the clothing industry today is close to the production of fabrics.

Practically now there are two types of clothing production: the first is for one’s own needs, characteristic of developed countries, with the great importance of workshops and fashion houses, where, along with production, “taste” and fashion style are formed. The second is the type of production of developing countries, which produce products for export according to the models of the leading fashion centers of the West; their clothing industry is represented along with powerful conveyor-type factories, a huge number of artisans, home-based workers, producing export products through the distribution offices of large export companies such products to the world market. The location of this industry in developed countries is predominantly large-city in nature. Metropolitan centers are often the main ones for the clothing industry. On a global scale, they stand out: Rome - as a center of mass fashion,

Paris - as the center of "high" fashion and New York - as the world's largest center of the clothing industry in general, counting in terms of production costs.

Developing countries are generally characterized by a dispersed location of the clothing industry, often even in rural areas, although there are some very large centers, such as Hong Kong.

Similar trends, especially related to the production of mass consumer goods, are characteristic of the CIS. Central Asia, Kazakhstan and Azerbaijan, where almost all cotton fiber and more than 25% of raw silk threads are produced, account for 17.8% of fabric production. The tendency of the textile industry to gravitate towards sources of raw materials is clearly increasing; however, the old trend of locating it in old industrial European regions of the CIS also persists. The production of artificial fiber by the chemical industry, helping to improve the raw material base of the textile industry, not only kept it in the traditional textile regions of the Center, North-West Russia, the Baltic states and other republics, but also expanded its geography.

But there are also significant differences, firstly, in the sectoral technological structure, associated with their weak diversification and obsolescence, and secondly, in the territorial structure, the latter applies to such industries as, for example, the clothing industry, which has received sufficient development in the form large associations in capital and large regional centers and poorly developed in other cities. Although this industry has a more dispersed location than the textile industry, the location of its facilities does not sufficiently correspond to the geography of consumption. As a result, the balanced development of a number of republics and many of their regions was not ensured. The above applies primarily to areas specializing in the production of heavy industry products.